In its Australian Intellectual Property Report 2017, IP Australia revealed that it received one percent fewer standard patent applications in 2016 than in the previous year. While this is first and foremost a bad sign for innovators, who are clearly finding it harder to justify spending on new products and services, and/or on patenting their developments, it is also not great news for Australian patent attorneys, who are operating in a very challenging business environment. The silver lining, according to the IP Australia report, was that Australian resident applicants filed 15% more standard applications in 2016 compared with 2015. You might expect that this would be good for the local patent profession.

In its Australian Intellectual Property Report 2017, IP Australia revealed that it received one percent fewer standard patent applications in 2016 than in the previous year. While this is first and foremost a bad sign for innovators, who are clearly finding it harder to justify spending on new products and services, and/or on patenting their developments, it is also not great news for Australian patent attorneys, who are operating in a very challenging business environment. The silver lining, according to the IP Australia report, was that Australian resident applicants filed 15% more standard applications in 2016 compared with 2015. You might expect that this would be good for the local patent profession.However, my own analysis of data released by IP Australia in the Intellectual Property Government Open Data (IPGOD) 2017 reveals a less rosy picture. Once innovation patents (down by over 4%) and provisional applications (up by just 0.2%, and twice as numerous as standard application filings) are taken into account, the growth in total Australian filings by Australian applicants is only 4%. Furthermore, all of this is derived from the increase in standard applications, which generally represent the same work, and the same value (to both the applicant and the attorney) as a standard filing by a foreign-resident applicant. For the most part, provisional applications – which represent the beginning of the patenting process in a majority of cases – are a more telling indicator of current and future innovative activities by clients, and thus of revenues for their attorneys. Yet provisional filings by Australian entities last peaked in 2012, before declining by nearly 10% in 2013, and have yet to recover to their former high.

Many IP services firms are no different from other businesses, in that they want to generate growth in profits, and deliver value to shareholders – whether these be traditional partners/owners of the firm, a corporate holding company, or investors in a public share market. With the Australian market for patent filing and prosecution services stagnating, growth must come through developing new service offerings, winning new clients away from competitors, and/or change and innovation within the firm to generate efficiencies, reduce costs, and grow the bottom line. All of these strategies require investment, whether it be in internal development, marketing, or technology innovation. It is hardly surprising, then, that some firms are pursuing innovative business avenues, such as public listings and acquisitions, to raise capital and build critical mass to make such investments.

A more complete analysis of Australian patent filing activity over 2015 and 2016 further reveals that:

- the top 10 Australian firms accounted for 65% of all patent filings in Australian in 2016

- members of publicly-listed groups dominate the top 10 overall, which includes only two independent firms;

- however, a more diverse picture emerges when looking specifically at filings by Australian applicants, who are significantly more likely to use the services of an independent firm, particularly if they are an individual rather than a corporate entity; and

- while there are many individual gains and losses in market share over the two years analysed, there is no sign (as yet, at least) of any general net tendency for clients to move in either direction between listed and independent firms.

Overall Australian Patent Filings

The chart below shows the share (%) of all Australian patent filings handled by the top 10 firms overall, for 2015 and 2016. The top three, for both years, are Spruson & Ferguson, Davies Collison Cave, and Griffith Hack. Notably, each of these firms is the largest member of one of the three publicly listed Australian IP groups, i.e. IPH Limited (ASX:IPH), QANTM IP Limited (ASX:QIP) and Xenith IP Group Limited (ASX:XIP) respectively. Fourth and fifth places are occupied by independent firms Phillips Ormonde Fitzpatrick and FB Rice. The remaining members of the top 10 are all members of listed groups: Pizzeys (IPH), Shelston IP (Xenith), FPA (QANTM), FAK Callinans (IPH), and Watermark IP (Xenith).

The only members of the top 10 to have gained market share in 2016 are FAK Callinans, FPA, FB Rice, and Griffith Hack (marginally). However, the movements overall are relatively small, and there does not appear to be any evidence at this stage of significant movement of business based upon whether a firm is independent or part of a publicly listed group.

The top 10 firms collectively accounted for 65% of all patent applications filed in Australia in 2016.

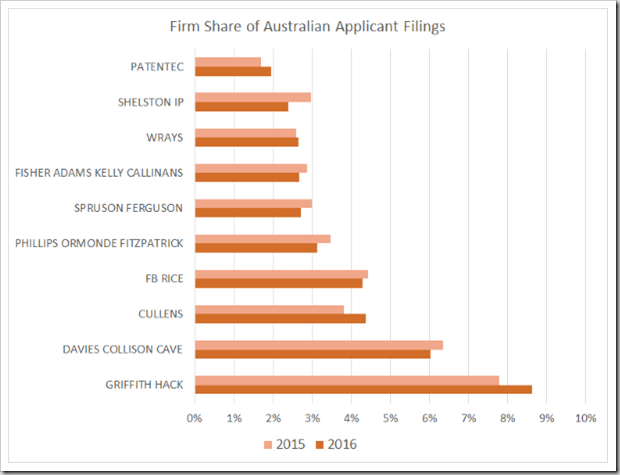

Filings by Australian Applicants

Patent applications filed by Australian applicants are of particular significance, because these represent the Australian firms’ local client base. While IP Australia data shows that over 90% of all filings in Australia in 2016 were made by overseas applicants, local clients account for a majority of the advisory and patent drafting work carried out by qualified Australian attorneys, and charged (mostly) on a time basis. And while foreign filing and prosecution work can be lucrative, due to its high volume and largely transactional nature, it is also most vulnerable to automation and disruption by non-traditional companies specialising in providing these services. In my view, therefore, maintaining a healthy local client business, relative to the number of attorneys in the firm, is critical to mitigating the risks presented by technology and associated new business models.The chart below shows the share (%) of all Australian patent filings having one or more Australian named applicants handled by the top 10 firms on this measure, for 2015 and 2016. The top overall filer, Spruson & Ferguson, rates only 6th here, with a market share of under 3% in 2016. Plainly, Spruson & Ferguson relies heavily on incoming foreign filing and prosecution work, and my understanding is that this is a deliberate strategy, and that it the firm has made the necessary technology investments to ensure that it can continue to compete with the specialists in this area.

Griffith Hack is a clear leader in Australian client filings, and appears to be growing its local market share. Members of listed groups are slightly less dominant in local client filings than in the overall (and hence foreign client) tally, with four independent firms in the top 10: FB Rice, Phillips Ormonde Fitzpatrick, Wrays, and Patentec.

Filings by Small-to-Medium Enterprises

The Australian government classifies a small-to-medium enterprise (SME) as a business having fewer than 200 employees. By linking Patent Office data to other government sources, the IPGOD 2017 set classifies Australian company applicants (as far as possible) into ‘small’ and ‘large’ according to this measure. Individual, i.e. non-corporate, applicants are also separately identified. The vast majority of businesses in Australia are sole traders or SMEs – according to the Australian Bureau of Statistics, in June 2016 just 0.2% of businesses employed 200+ people. Accordingly, SMEs are important not only to the Australian economy generally, but also as clients/customers to other Australian businesses, such as IP service providers.The chart below shows the share (%) of all Australian patent filings having only Australian SMEs as named applicants handled by the top 10 firms on this measure, for 2015 and 2016. And while Griffith Hack is the market leader for Australian clients generally, it is an extremely clear leader in the SME category, responsible for almost exactly twice the number of filings as its nearest competitor, Davies Collison Cave, in 2016.

Unsurprisingly, considering the dominance of SMEs in Australian business numbers, the make-up of the top 10 is very similar to that of Australian applicant filings more broadly, the main difference being that Watermark IP takes the place of Patentec in 10th place.

Filings by Private Individuals

The reason for Patentec’s displacement by Watermark in the SME category is immediately apparent from the following chart, which shows the share (%) of all Australian patent filings having only Australian private individuals as named applicants handled by the top 10 firms on this measure, for 2015 and 2016. In this market segment, Patentec is second only to Cullens, confirming that its place in the top 10 for Australian resident applicants is due primarily to individual, rather than corporate, applicants.

It is also notable that private individuals spread their business over a much wider range of firms – there are a number of smaller service providers in the top 10 here, and the individual market share of each is lower than in other categories. Even the local client ‘powerhouses’, Griffith Hack and Davies Collison Cave, despite their size and market clout, are not outstanding performers in the ‘individual applicant’ segment. I doubt, however, that this will bother them very much – it is really not their target market.

Filings by Australian Large Entities

The chart below shows the share (%) of all Australian patent filings having at least one Australian-resident large entity as a named applicant handled by the top 10 firms on this measure, for 2015 and 2016. In addition to large enterprises, this category also includes most universities and research institutions, which generally employ more than 200 staff across all of their areas of activity.

Larger IP service firms dominate the category. The top 10 firms account for 83% of all filings by Australian large entities. The above chart suggests that this may be an ongoing trend, with all of the top five, and seven out of the top 10, having grown their market share in 2016 over 2015. There is, additionally, a fairly even split between independent firms and members of listed groups.

It should be noted, however, that this is all off a fairly small base – in 2016 there were only 920 applications filed by Australian large entities, via a total of 56 firms, of which just 33 handled more than one application, with 20 of those handling fewer than 10 each.

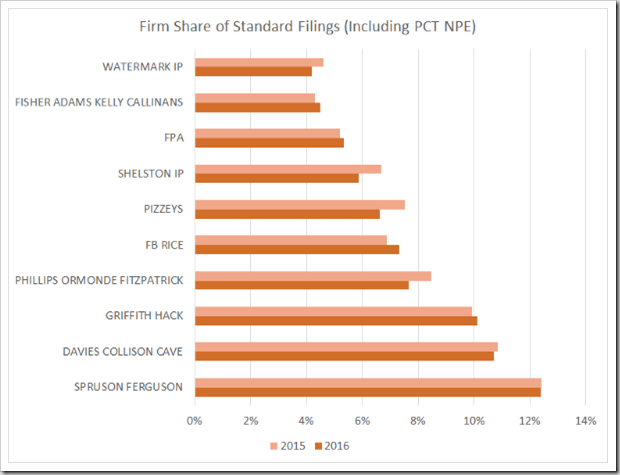

Filings by Type of Application

The chart below shows the share (%) of all Australian standard patent application filings (including direct/convention filings and PCT applications entering the national phase) handled by the top 10 firms on this measure, for 2015 and 2016. The vast majority of such applications are made by foreign entities, and the rankings here are therefore the same as for overall filings.

The next chart below shows the share (%) of all Australian provisional filings handled by the top 10 firms on this measure, for 2015 and 2016. Almost all provisional applications are filed on behalf of local Australian clients, and the majority involve preliminary advice and drafting services. Thus, although the order is slightly different, it is not so surprising that the leading firms in this category are the same ones that lead filings on behalf of Australian clients generally. Notably, Davies Collison Cave lost market share in 2016, while Griffith Hack made gains that saw the two firms swap places at the top of the table (that is to say, at the bottom of the chart).

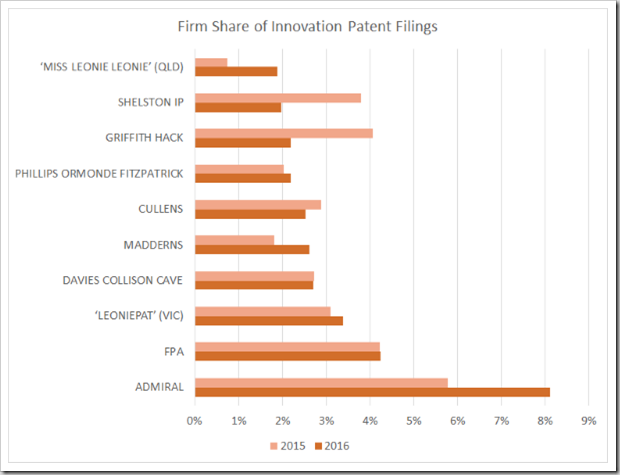

Finally, just for fun, the chart below shows the share (%) of all Australian innovation patent filings handled by the top 10 firms on this measure, for 2015 and 2016. These rankings are completely distorted by the Chinese abuse of the system, about which I have written on a number of previous occasions (most recently in Users and Abusers of the Australian Innovation Patent System and How IP Australia Has Been Quietly Curbing Abuse of the Innovation Patent System). The top filer, Admiral, appears to specialise in providing services to Chinese innovation patent applicants, while I have placed two of the entries in the top 10 in quotation marks, on the basis that they appear to be pseudonyms for possibly the same individual purportedly operating out of addresses in Victoria and Queensland. Frankly, this behaviour serves only to bring the whole innovation patent system, and those who are using it legitimately, into disrepute.

Listed vs Independent Service Providers

It is fair to say that there has been much consternation about the ‘consolidation’ of a number of Australian IP service providers into the three groups owned by ASX-listed entities IPH Ltd, Xenith IP Group Ltd, and QANTM IP Ltd. A recent survey suggested that clients are not well-informed about these changes in the Australian profession, or what they mean in terms of independence of advice and representation, while the Trans-Tasman IP Attorneys Board (TTIPAB) is in the midst of a review of the Code of Conduct For Patent and Trade Marks Attorneys in which it is looking to provide additional guidelines on managing and avoiding conflicts-of-interest among commonly-owned firms. There are also concerns about whether these new corporate structures are adversely impacting competition in the Australian market (although, to be honest, most of these concerns are coming from independent Australian patent attorneys, and not from the market or the regulator).The chart below shows the split in share of 2016 Australian patent filings between firms in listed groups, and independent firms, across:

- all applicants (i.e. Australian and foreign residents, of all types);

- Australian applicants (including individuals, SMEs, and large entities);

- Australian SME applicants; and

- Australian private individual applicants.

While there has been some comment to date on the fact that over half of all applications filed in Australian are handled by listed firms (54.2% in 2016), this is largely due to the dominance of three of those firms – Griffith Hack, Davies Collison Cave, and Spruson & Ferguson – in the foreign applicant segment, which precedes the recent changes.

Looking specifically at the Australian market for IP services, however, independent firms still collectively provide a majority of services: 69% of Australian applicants overall; 62% of Australian SMEs; and an overwhelming 86% of all Australian private individual applicants. This is despite the fact that the listed groups include a majority of Australia’s best-known brands in the market, and employ over a quarter of all registered Australian patent attorneys (keeping in mind that many who are registered are not necessarily full-time practitioners).

To my mind, this is further evidence – if any were required – that the Australian market for IP services remains healthy, with local clients continuing to select providers that suit their requirements, regardless of whether they are members of listed groups or not.

Conclusion – The Market Remains Challenging

Patent attorney firm filing data for 2015 and 2016 shows just how competitive the market remains in Australia. While the overall number of Australian resident filings (standard, innovation, and provisional applications) grew slightly in 2016 (by around 4%), there was an overall decline in overseas-originating filings, leaving the total size of the market for Australian patent filings substantially static (just 0.6% growth). In this context, the fluctuations in market share of the leading firms are significant, and reflect the challenges of competing for a larger share of the same-sized pie!There is no indication that changes in the Australian IP profession, and particularly the consolidation of some major firms into commonly-owned (and publicly-listed) groups, are having a major impact on client movement. In particular, there is, as yet, no sign of any general migration of filing work from listed to independent firms, or vice versa. It remains to be seen whether structural changes within the listed groups will result in efficiencies across their businesses that will enable them to achieve greater profitability from the same market share and/or to provide new, enhanced, or cheaper services and grow market share. In the latter case, it seems likely that such growth would come at the expense of independent firms, given the static state of the overall market.

In any event, it does not look like the business of being a patent attorney in Australia is getting any easier.

Before You Go…

Thank you for reading this article to the end – I hope you enjoyed it, and found it useful. Almost every article I post here takes a few hours of my time to research and write, and I have never felt the need to ask for anything in return.

But now – for the first, and perhaps only, time – I am asking for a favour. If you are a patent attorney, examiner, or other professional who is experienced in reading and interpreting patent claims, I could really use your help with my PhD research. My project involves applying artificial intelligence to analyse patent claim scope systematically, with the goal of better understanding how different legal and regulatory choices influence the boundaries of patent protection. But I need data to train my models, and that is where you can potentially assist me. If every qualified person who reads this request could spare just a couple of hours over the next few weeks, I could gather all the data I need.

The task itself is straightforward and web-based – I am asking participants to compare pairs of patent claims and evaluate their relative scope, using an online application that I have designed and implemented over the past few months. No special knowledge is required beyond the ability to read and understand patent claims in technical fields with which you are familiar. You might even find it to be fun!

There is more information on the project website, at claimscopeproject.net. In particular, you can read:

- a detailed description of the study, its goals and benefits; and

- instructions for the use of the online claim comparison application.

Thank you for considering this request!

Mark Summerfield

0 comments:

Post a Comment