In 2016, 24,331 patent applications were accepted for grant by IP Australia. Based on the examination sections to which these applications were allocated, the top technology areas were mechanical engineering (11%), process engineering (10.6%), and construction and mining (9.8%). And 80% of all these patent applications were handled by just ten firms. The top three firms – Spruson & Ferguson, Davies Collison Cave, and Griffith Hack – account for over a third of all applications accepted in Australia.

In 2016, 24,331 patent applications were accepted for grant by IP Australia. Based on the examination sections to which these applications were allocated, the top technology areas were mechanical engineering (11%), process engineering (10.6%), and construction and mining (9.8%). And 80% of all these patent applications were handled by just ten firms. The top three firms – Spruson & Ferguson, Davies Collison Cave, and Griffith Hack – account for over a third of all applications accepted in Australia.The process of guiding an application through the examination process is commonly known as prosecution. While local clients generally require a wider range of value-added services, such as advice on patentability and drafting of patent specification, over 90% of all Australian patent applications originate with overseas applicants that primarily require prosecution services. And since Chapter 20 of the Australian Patents Act 1990 effectively gives registered patent attorneys an exclusive role in providing paid services to complete key tasks required for successful prosecution of a patent application, these services are the ‘bread and butter’ of many of the larger patent attorney firms in Australia.

In this article I will look at the ten firms that power four fifths of all Australian patent prosecution, and the areas of technology in which they operate. It is important to appreciate, however, that this is not intended as a recommendation of the services these firms provide in relation to any particular technology. Each firm in the top ten is large enough to employ attorneys with a range of technical backgrounds, and handles applications across all of the technology areas examined by IP Australia. Self-evidently, far greater specialisation is found in smaller firms, which have fewer attorneys. Small firms also tend to provide a greater proportion of their services to local Australian clients, and to engage in less of the high-volume incoming prosecution work on behalf of foreign applicants. A number of smaller firms therefore appeared in my earlier analysis using filing data broken down to distinguish Australian small and large business applicants. A firm’s experience, and success, in patent prosecution is therefore just one consideration among many in the selection of an Australian IP service provider.

Acceptance Data and Technology Categories

The following analysis is based on data released by IP Australia in the Intellectual Property Government Open Data (IPGOD) 2017. In particular, I extracted records of every patent application that was accepted for grant (i.e. successfully passed examination) during the 2016 calendar year, along with the agent of record (i.e. the Australian attorney firm that handled the application), and the IP Australia examination section to which the application was allocated.IP Australia divides its examination teams into 14 sections, namely:

- five chemical technology sections – biotechnology, chemical compounds, pharmaceuticals, polymers and applied chemistry, and OPW chemistry (I confess that I am not sure what ‘OPW’ stands for, but assume that this is a catch-all for chemical technologies that do not fall into the other four categories);

- three electrical technology sections – physics, electronics and communications, and computing;

- five mechanical technology sections – mechanical engineering, construction and mining, process engineering, medical devices, and packaging and appliances; and

- a ‘mixed technology’ section, which cuts across all areas of technology (and is therefore not very helpful in identifying the technical field of an application).

As can be seen, the top three sections are all mechanical technologies, i.e. mechanical engineering, process engineering, and construction and mining. The next most prevalent categories are the electrical technologies, electronics and communications, and physics.

Around 10% of all Australian patent applications are allocated to the ‘mixed technology’ section, and a similarly even distribution is seen across individual firms. Assignment to this section is therefore not useful for distinguishing the technology area of an application, and it is excluded from the further analysis as a consequence.

Finally, it is notable that less than 1% of all applications are allocated to the packaging and appliances section.

Australia’s Top Patent Prosecution Firms

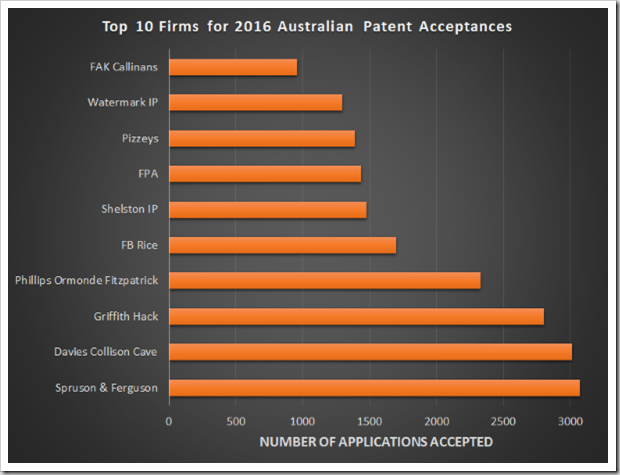

Australia’s top 10 patent prosecution firms are shown in the chart below.

There are, broadly speaking, two tiers of patent prosecution firms in the top 10, with Fisher Adams Kelly (FAK) Callinans, Watermark IP, Pizzeys, FPA, Shelston IP and FB Rice making up a lower group having fewer than 2000 acceptances each in 2016, and Phillips Ormonde Fitzpatrick (POF), Griffith Hack, Davies Collison Cave, and Spruson & Ferguson being the upper tier with greater than 2000 acceptances (although POF might be regarded as falling into a class of its own, bridging an otherwise hefty gap between the top three and the lower six firms).

Though not shown in the above chart, the 11th-placed firm, Cullens, was responsible for just over half of the number of acceptances as FAK Callinans in 2016, and so there really is another significant step down beyond the top ten.

As I have already noted, the top ten firms accounted for almost exactly 80% of all acceptances (19,460, or 79.98%). The top three alone accounted for 8888, or 36.5%, of acceptances in 2016.

Firm Specialisations

In order to identify any particular specialisations of individual firms, I computed the fraction of each firm’s acceptances allocated to each one of the 13 IP Australia examination sections (excluding mixed technology). This process obscures the differences in absolute numbers of applications handled by each firm, while highlighting any notable areas of technology in which an individual firm performs a significant proportion of its prosecution work. The results of this analysis, for all firms and all examination sections, are shown in the 3D chart below.

Unfortunately, the perspective in the 3D chart makes it difficult to compare precisely between firms and technologies, and the following charts therefore present the same data in 2D form, now also excluding packaging and appliances cases, which are few in number and fairly evenly distributed across firms.

While all firms in the top ten handle a comparable proportion of work in mechanical and process engineering, physics, and OPW chemistry fields, there are some notable stand-outs in some other technology areas. These include:

- FPA in computing;

- FB Rice in construction and mining;

- Griffith Hack, Phillips Ormonde Fitzpatrick, and Watermark in electronics and communications;

- FAK Callinans in medical devices;

- Pizzeys in biotechnology and pharmaceuticals;

- Davies Collison Cave in chemical compounds; and

- Shelston IP in polymers and applied chemistry.

It is also necessary to look across categories. Again focussing on FPA, the firm actually performs a slightly higher proportion of all its prosecution work in construction and mining, although it is somewhat overshadowed by FB Rice in this technology area.

Broadly speaking, however, all of the top ten firms have experience and capability across most technology areas. The only (possibly) stand-out examples of firms performing a lower proportion of work than their competitors in particular technology areas are Pizzeys in construction and mining, FB Rice in electronics and communications, and Phillips Ormonde Fitzpatrick in biotechnology. However, this says nothing about the quality of these firms’ work in these areas – they may have fewer practitioners qualified to handle these technologies, but that does not mean that those they do have are not highly skilled.

Conclusion – Finding the Right Attorney/Firm?

While just three agents were responsible for 36.5% of acceptance in 2016, and the top ten accounted for 80% of acceptances, there are many more firms and individuals providing patent attorney services in Australia. A total of 80 agents handled 99% of all accepted applications, with the remaining 1% (243 applications) being managed by dozens of small firms, sole practitioners, and applicants acting on their own behalf. Thus, while it is interesting to look at the distribution of work conducted by the top prosecution firms, this falls somewhat short of providing a complete picture.If you are a prospective patent applicant, you may be wanting to identify a firm or attorney with particular expertise in the field of technology of your invention. And if, for whatever reason, you are set on using one of the larger firms – and of course there are pros and cons to going with a big ‘brand name’ firm – then the data presented above may be of some use. Beyond this, however, there may be no substitute for putting in the work to track down the most suitable individual attorney, regardless of where they may happen to work. Unfortunately, patent examination data may be of little assistance here. As with other professional service providers, patent attorneys can be found by way of searching the web or professional networking sites such as LinkedIn, along with more traditional methods such as word of mouth, and calling around potential candidates.

There is, in short, much more to finding the right attorney than their statistics.

Before You Go…

Thank you for reading this article to the end – I hope you enjoyed it, and found it useful. Almost every article I post here takes a few hours of my time to research and write, and I have never felt the need to ask for anything in return.

But now – for the first, and perhaps only, time – I am asking for a favour. If you are a patent attorney, examiner, or other professional who is experienced in reading and interpreting patent claims, I could really use your help with my PhD research. My project involves applying artificial intelligence to analyse patent claim scope systematically, with the goal of better understanding how different legal and regulatory choices influence the boundaries of patent protection. But I need data to train my models, and that is where you can potentially assist me. If every qualified person who reads this request could spare just a couple of hours over the next few weeks, I could gather all the data I need.

The task itself is straightforward and web-based – I am asking participants to compare pairs of patent claims and evaluate their relative scope, using an online application that I have designed and implemented over the past few months. No special knowledge is required beyond the ability to read and understand patent claims in technical fields with which you are familiar. You might even find it to be fun!

There is more information on the project website, at claimscopeproject.net. In particular, you can read:

- a detailed description of the study, its goals and benefits; and

- instructions for the use of the online claim comparison application.

Thank you for considering this request!

Mark Summerfield

0 comments:

Post a Comment