We are sure that someone out there has been wondering – ‘suppose I wanted to buy Australia, lock, stock and big-red-rock, how much would I expect to pay?’

We are sure that someone out there has been wondering – ‘suppose I wanted to buy Australia, lock, stock and big-red-rock, how much would I expect to pay?’This might not actually be such a bad plan – consider how much (or, indeed, how little) of the mortgage on a new house you might be able to pay off by redirecting just half of your household budget for only five years. Look at it that way, and Australia is a bargain for a big country like the United States. Now please, nobody tell China!

A summary of the analysis appears in a recent edition of Ruthven’s regular ‘from the desk of…’ newsletters. We think that these may only go out to subscriber organisations, so we will reproduce only one image for the purpose of comment, in the hope of staying within the ‘fair dealing’ provisions of the Copyright Act.

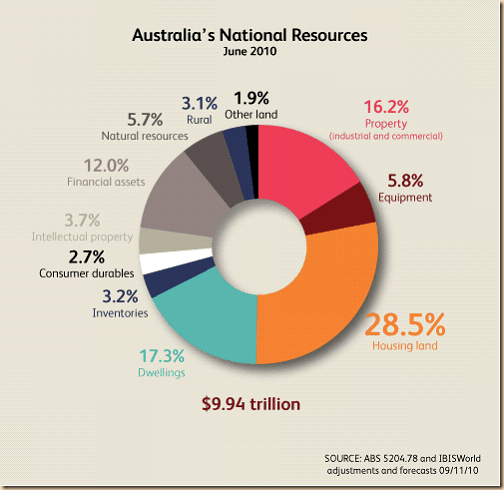

The graphic below illustrates the breakdown of the total $9.94 trillion book value by different asset classes.

It is not surprising that physical property (land, bricks and mortar) makes up such a large proportion of Australia’s value. However, considering that the economy is supposedly riding high on a resources boom that has seen us through the GFC, and now sees the Australian dollar sitting high and dry at unprecedented levels as other global economies struggle, we were surprised to see natural resources contributing only 5.7% of the total value.

By comparison, intellectual property contributes 3.7% – or about A$368 billion – to the county’s book value. We would like to know where all this IP can be found, and how we can cash in on it! If the nation’s IP is worth 65% (i.e. nearly two thirds) of the value of its natural resources, then is it contributing a similar proportion to national income? We should just as surely be riding an IP boom as a mining boom!

And if we are not extracting sufficient value from the nation’s IP, then why not, and what is to be done about it? We would advise any client with substantial intellectual assets that they need to conduct an IP audit, and put an IP strategy in place, so who is doing this for Australia? It certainly does not seem to be an element of current ‘innovation policy’, which seems largely to involve trying to find new ways to distribute limited government funds to promising areas of research, development and commercialisation. But who is looking at the IP that is already out there, and how Australia can make the most of it?

Finally, if Australia cannot extract a better rate of return from its ‘national IP portfolio’, perhaps it would be preferable to sell it off, and use the money to buy something the nation can exploit more effectively. Like, say, New Zealand… (Just kidding.)

All this is just based on the book value. As Ruthven has also pointed out, the value at auction could be much higher – always assuming that competing bidders can be found.

Before You Go…

Thank you for reading this article to the end – I hope you enjoyed it, and found it useful. Almost every article I post here takes a few hours of my time to research and write, and I have never felt the need to ask for anything in return.

But now – for the first, and perhaps only, time – I am asking for a favour. If you are a patent attorney, examiner, or other professional who is experienced in reading and interpreting patent claims, I could really use your help with my PhD research. My project involves applying artificial intelligence to analyse patent claim scope systematically, with the goal of better understanding how different legal and regulatory choices influence the boundaries of patent protection. But I need data to train my models, and that is where you can potentially assist me. If every qualified person who reads this request could spare just a couple of hours over the next few weeks, I could gather all the data I need.

The task itself is straightforward and web-based – I am asking participants to compare pairs of patent claims and evaluate their relative scope, using an online application that I have designed and implemented over the past few months. No special knowledge is required beyond the ability to read and understand patent claims in technical fields with which you are familiar. You might even find it to be fun!

There is more information on the project website, at claimscopeproject.net. In particular, you can read:

- a detailed description of the study, its goals and benefits; and

- instructions for the use of the online claim comparison application.

Thank you for considering this request!

Mark Summerfield

0 comments:

Post a Comment